Introduction Basics of Accounting is a finance support system that

- Records transactions.

- Classifies transactions and events.

- Expresses transactions in monetary terms.

- Helps to monitor the financial performance and condition of the business.

- Helps to evaluate the business.

- Helps to establish controls for the business.

Introduction Basics of Accounting helps to arrive at the financial position of the organization at any point of time. The organization’s financial status, as on a particular date, is captured in the balance sheet, while financial performance for the year is summarized in a profit and loss statement.

Accounting Principles, Concepts and Conventions– BASICS OF ACCOUNTING

Introduction Basics of Accounting concepts form the basis for preparation of financial statements. Accounting statements, such as external “financial accounts” or internally focused “management accounts,” which reflect the “true essence” of the business and the results of its operation.A number of principles, concepts and conventions are used to ensure that accounting information is presented accurately and consistently. Some of these concepts are briefly described in the following sections.

Revenue Realization-BASICS OF ACCOUNTING

The realization principle deals with how revenue is recognized by a business.

Revenue is recognized only when

- It is realized (when an asset is sold or exchanged).

- It is legally due and-reasonably collectible.

Matching Concept-BASICS OF ACCOUNTING

In an accounting period, the revenue that is reported must be set off against the expenses incurred to generate that revenue. This gives a true picture of the profit earned in that period.

Accrual

Accrual is a method of accounting that recognizes revenue when earned rather than when due or collected, and expenses when incurred rather than when paid. Thus under accrual, transactions are recorded on the basis of income earned or expense incurred, irrespective of actual receipt or payment. For example, a seller bills the buyer at the time of sale and treats the bill amount as revenue, even though the payment will be received later.

Note

The case basis of accounting is a method wherein revenue is recognized when actually received, rather than when earned and expenses are booked when actually paid, rather than when incurred. This method is usually not considered to be in conformity with accounting principles and is, therefore used only in select situations such as for very small businesses.

Going Concern

Transactions are recorded on the assumption that a business will remain will operation long enough for all of its current plans to be carried out.

Accounting Period

Financial statements are generated for relatively shorter periods, such as a year or a quarter, so that performance can be measured and compared.

Business Entity

The business entity principle views the business as an entity separate from its owner(S). Consider the example of a business owned by a person. When the owner of the business takes money from the business for his personal use, the transaction is recorded as the owner receiving money from the business, though the business and its assets belong to him.

Money Measurement

In accounting, all transactions are measured using a common unit of measurement, which is money. Only transactions that can be expressed in terms of money are recorded.

Features Double Entry System of Book Keeping-BASICS OF ACCOUNTING

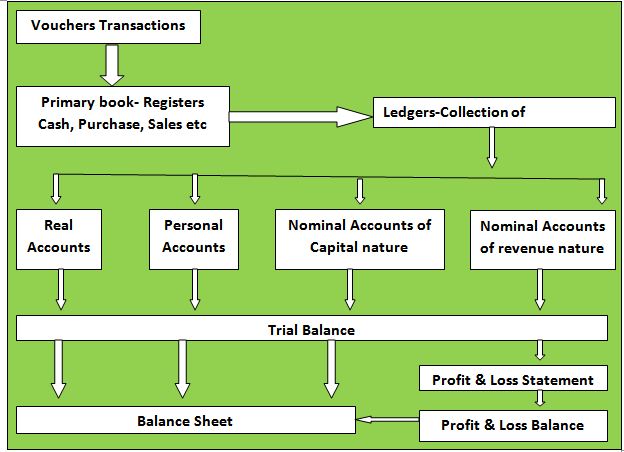

Double Entry accounting is a system of recording transactions in a manner that maintains the equality of the accounting equation. This accounting technique records each transaction as a debit and a credit, where every debit has a corresponding credit and vice versa. The following chart explains the way in which accounting transactions are recorded in the Double Entry system and financial statements are prepared.